Fannie Mae Form 191 2012-2026 free printable template

Show details

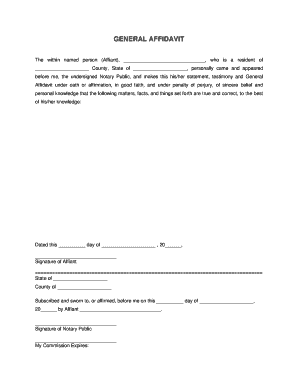

SHORT SALE AFFIDAVIT Service: Service Loan Number: Address of Property: Date of Purchase Contract: Investor: / / Seller: Buyer: Seller: Buyer: Seller’s Agent/Listing AgentBuyer’s’s Agent: Escrow

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fannie mae form 191 fill ease of use

Edit your fannie affidavit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your short sale affidavit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fannie mae site pdffiller com site blog pdffiller com online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fnma purchase contract requirements form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out borrower certification form

How to fill out Fannie Mae Form 191

01

Obtain a copy of Fannie Mae Form 191.

02

Begin filling out the necessary borrower information, including names and addresses.

03

Enter the property address for the mortgage application.

04

Provide information about the loan amount and terms.

05

Complete the income and asset sections with accurate financial details.

06

Disclose any liabilities or debts associated with the borrower.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form as required.

Who needs Fannie Mae Form 191?

01

Lenders offering Fannie Mae-backed loans.

02

Borrowers applying for a Fannie Mae mortgage.

03

Real estate agents assisting clients with mortgage applications.

04

Mortgage brokers facilitating the loan process.

Fill

mae forms

: Try Risk Free

People Also Ask about

Does a bill of sale in Michigan need to be notarized?

Michigan Vehicle Bill of Sale Requirements. Vehicle bills of sale in Michigan do not require notarization. However, whether your document is hand-drafted or pre-printed, it should contain the following criteria: The names, contact information, and signatures of the buyer and the seller.

Can a bill of sale be handwritten in Texas?

Can you hand write a bill of sale in Texas? It is important to make sure all the requirements for the respected state law are included in the bill of sale. As, with any legal written document a bill of sale can be handwritten.

Is a hand written bill of sale OK?

Can a bill of sale be handwritten? If your state does not provide a bill of sale form, yes, you can handwrite one yourself. As long as the document includes all of the necessary parts of a bill of sale and is signed by both parties and a notary, it is valid.

Is a handwritten bill of sale OK?

Can a bill of sale be handwritten? While it is common to present a bill of sale in a digital format, you can also create a handwritten bill of sale. What's most important is to include all of the pertinent details in the bill of sale in order to protect both parties.

Do you need a bill of sale in Michigan?

The State of Michigan requires a bill of sale, among other documentation, upon transferring a vehicle's title and registration from a previous owner to a new one. The form stipulates the vehicle's purchase price, condition, and any additional terms set by the agreeing parties.

Does a bill of sale need to be notarized in Ohio?

Junk Vehicles The buyer and seller must also sign a bill of sale and have it notarized. This is to protect buyers from unknowingly buying a vehicle that is unlikely to be fully insurable and may be dangerous.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the Fannie Mae Form 191 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an electronic signature for signing my Fannie Mae Form 191 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your Fannie Mae Form 191 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I edit Fannie Mae Form 191 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing Fannie Mae Form 191 right away.

What is Fannie Mae Form 191?

Fannie Mae Form 191 is a document used for reporting and documenting mortgage loans that are eligible for sale to Fannie Mae, including details about the borrower's financial information and the property's characteristics.

Who is required to file Fannie Mae Form 191?

Lenders and mortgage originators who are proposing to sell mortgage loans to Fannie Mae are required to file Form 191.

How to fill out Fannie Mae Form 191?

To fill out Fannie Mae Form 191, follow the instructions provided in the form, which includes providing information about the borrower, property address, loan amount, and lender details, ensuring all sections are completed accurately.

What is the purpose of Fannie Mae Form 191?

The purpose of Fannie Mae Form 191 is to facilitate the collection of data necessary for the underwriting and purchasing processes for mortgage loans in the secondary market.

What information must be reported on Fannie Mae Form 191?

The information that must be reported on Fannie Mae Form 191 includes borrower details, loan terms, property information, and financial statements that support the loan application.

Fill out your Fannie Mae Form 191 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fannie Mae Form 191 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.